Leaders often feel that their years of experience give them the knowledge and perspective they need in order to make informed decisions. In reality, this can lead to making decisions based on assumptions that are biased by their own experiences and not informed by the experiences of others.

In fact, collecting feedback from key stakeholders is essential to ensuring that the decisions you make are aligned with what your parents, students, staff, and community members need and want. Moreover, when you ask your stakeholders what matters to them, you convey a message that their opinions matter. This helps to build trust in your leadership abilities and choices, and generates buy-in and support for your decisions.

So, whether you are trying to improve student outcomes, retain your staff, build community trust and engagement, or develop a strategic plan for your district, you will make better decisions if you understand the diverse experiences of your stakeholders.

In our Equitable Inclusion Guide, we compare various strategies for collecting stakeholder feedback and note the following benefits of using a targeted survey:

We all acknowledge that our most marginalized students experience inequities within our schools. There are structures, policies, and procedures that prevent them from receiving a high-quality, exceptional education. As leaders, it is our responsibility to dismantle those barriers. But where to begin? How do you begin to take the first steps to leading with an equity focus?

Leading with Equity: How to Take the First Steps

Why are student surveys in particular important?

When collected effectively, student feedback can be extremely valuable. This is especially true when it comes to identifying improvements to school culture, learning environments, and instructional practices in order to drive student performance.

The Measures of Effective Teaching (MET) project – a rigorous study of 3,000 teachers – found that students consistently identified instructional and environmental strengths and weaknesses, regardless of the students’ ability level. In other words, students know effective teaching when they experience it. Students can perceive the teacher’s ability to control a classroom as well as their ability to challenge them with rigorous work. Moreover students can perceive their teacher’s ability to provide support for emotional security.

The MET project also identified the following benefits of collecting student feedback via surveys:

Article: Improving Teaching with Expert Feedback - From Students - Edutopia

Report: Uncommon Measures: Student Surveys and Their Use in Measuring Teaching Effectiveness - American Institutes for Research

Report: Learning about Teaching: Initial Findings from the Measures of Effective Teaching Project. Research Paper. MET Project - ERIC

Blog: The Importance of Involving Stakeholders Throughout the Strategic Planning Process

Guide: Framework for Effective Teaching - Tripod

Services: Tracking Progress Towards Equity and Excellence

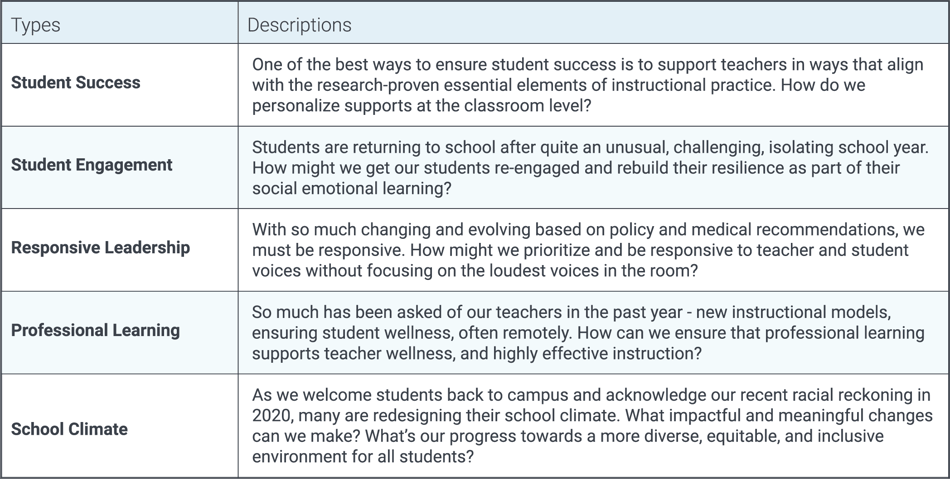

The table below outlines the most common types of surveys we are asked to support for our school and district clients.

What makes a good survey?

The best surveys start with a clearly defined purpose. Begin your survey project with a clear vision for how you plan to use the survey data - what questions are you trying to answer? What decisions will you hopefully be able to make? What decisions can others make? And, is perception data the right kind of information to help make those decisions?

Once your purpose is clearly defined, the next challenge is to develop the best instrument or set of questions for your survey. If you’re developing a new survey, you’ll want to work with a survey expert who knows how to develop high quality survey questions that are free from bias and can reliably get you the information you need to serve your purpose. Survey writing can seem easy; it’s tempting to write questions on your own without the guidance of an expert. However, most individuals find out too late (i.e. when they have already administered their survey and are beginning to look at the data) that they’ve overlooked mistakes in their survey writing that impact the quality of their data. Simply put - if your survey questions are bad, your data and analysis will be poor.

If possible, rather than developing a new survey, choose an existing survey instrument with established validity. Validity means that the survey instrument measures what it is supposed to measure. You can rely on the fact that the data will be accurate. Validity is established by using the instrument over and over and studying the results. You can only determine the extent to which a survey is accurate by using it, and using it a lot.

Education Elements’ “Tripod’s 7Cs” survey — named for the 7 indicators of exceptional teaching practice – has, for example, been administered since 2001 to millions of students, tens of thousands of teachers, and thousands of schools across the country. Every time the surveys are used, we learn more about how to improve the accuracy of the data they produce, and now the instruments are in their 18th generation. If you can find a survey instrument with established validity that aligns with the purpose of your project, choosing this survey over developing your own will improve the likelihood that you get valuable and accurate data.

Once you’ve selected or developed the best survey instrument for your purpose, you’ll want to make sure you can analyze the data in ways that answer your research questions. If you’re trying to understand how student perceptions differ by grade bands, you will need to know if the students responding to your questions are in elementary school, middle school, or high school. (Not to mention the fact that you’ll want surveys that ask questions in an age-appropriate way for each grade band.) Some survey platforms provide powerful ways to prepopulate this information for each survey participant, which cuts down on the length of the survey and typically leads to more accurate information. And, if this isn’t an option, you’ll want to include demographic questions in your survey so that participants can self report this information.

Finally, you need a thoughtful survey administration and promotion plan. Even the best written surveys will fail if no one takes them. To make sure you get the highest response rates possible, consider the following:

Blog: How Bias Affects Our Perceptions of Data: 3 ways to guard against unconscious bias

Article: Validity of Your Survey Results - National Business Research Institute

Guide: How to use the School Survey of Practices Associated with High Performance - National Center for Education Evaluation and Regional Assistance

What do we do with survey data?

Once you have your survey data back, the next challenge is to uncover the insights that answer your research questions – insights that will be used by your team. The most efficient way to conduct this analysis is to return to the research questions you drafted during the planning stage. Disaggregate the data in ways that help you answer those questions and understand the nuances of the data. You’ll also want to keep your eyes open for surprises along the way. Don’t ignore interesting learning or findings just because it falls outside of your original purpose.

There are often two critical audiences with whom you’ll want to share the results of your findings and strategies to keep in mind of each audience. First, when sharing the results with your decision-makers, resist the urge to share all of the data. Instead, highlight the most important findings, those that most closely align with the decisions to be made, and/or the findings with the biggest implications related to those decisions. Use graphics that make those findings easy to interpret without explanation, and be sure to include any notes that should impact how those findings were interpreted. For example, if the survey was administered to all stakeholders, but one question was only given to parents, you’ll want to note that exception near your graphic so that any related finding is not misinterpreted.

All this said, knowing information and using information are two different things. You’ll want to create intentional opportunities for your decision makers to put the survey data to work - ways they can apply the information to inform their future decisions and leadership. In our Guide to Tripod’s 7Cs Framework of Effective Teaching, we provide reflection questions and sample strategies to help teachers identify how they can use the feedback they get from their students through this survey.

In addition to your decision-makers, you’ll want to share the survey findings (and how they are being used) with your stakeholders who took the survey. Doing so builds trust and demonstrates your care about their opinions, perceptions, and experiences. And by leveraging their feedback, you are more likely to co-create solutions that reflect your stakeholder needs and build support for any next steps.. It also increases the likelihood that these stakeholders will participate in future surveys.

When sharing survey data with this audience, be careful to avoid “check the box transparency”, which happens when the data are dumped somewhere that is difficult to find or impossible to understand. “I shared the data, check!” True transparency is relational, not transactional, which means the data are shared in a way that respects and recognizes the audience. It should be easy to access and understand. For more ways to rethink how you share information, check out this webinar.

The Power of Feedback Webinar | Using Surveys to Drive Student Outcomes

How Do Districts Get Started

To get started, first identify the purpose of your survey project and clearly articulate the questions you are hoping to answer. Look for a survey instrument that can help you answer those questions, or reach out to an expert for helping creating a new one. Connect with us if you’d like more information about our Tripod’s suite of surveys, or if you’re looking for help with your survey project.